Hierarchical categorisation provides both top-view and detailed-view. It is the most common system being used by large and small companies and goverment accounting all over the world. Enterprise systems use numbers to refer to accounts. Librant uses actual account names instead.

First level accounts are fixed accounts in Librant. We will often name them "categories" in Librant terminology.

You can create sub-accounts under these first level accounts Hierarchically. For example:

The term "End-Account" indicates accounts which have no sub-accounts.

There are some rules about End-Accounts and Parent-Accounts

A double entry system means every expense or income needs a source account. e.g. If some money is credited to your wallet, same amount must be debited from another account. Vice versa, If you spend some money from your wallet, the same amount must be credited to another account such as Expenses->Bills. This is the most common system being used by large and small companies and goverment accounting all over the world same as hierarchical categorisation.

To use Librant, it is important to understand double entry system's logic. Each transaction has two legs.

Note: Enterprise systems use debit and credit terms instead of from and to.

For example: See the transaction below.

This transaction will effect these 2 accounts' balances. Their balances will be like below on the assumption that their balances were 0 before the transaction.

Each root account(category) and their sub-accounts have a specific natures and behaviorual patterns.

I am sure you would like to see how much money you have in your bank account at the moment.

The accounts under Assets naturaly have a positive balance because you cannot spend a value that doesn't exist. If you do, it means it is not an asset. For example you cannot spend money from your wallet if your wallet is empty. Of course, there are some exceptions such as - your bank may allow you spend some money from your account even if there is not enough money.

Assets are able to be increased or decreased. When your salary is paid into your bank account, your bank account will be in Debit(To) side. When you pay your bills, your bank account will be in Credit(From) side.

You would like to see how much debth you owe to your bank or your friend.

The accounts under of Debits are naturaly have negative balance. Sure, there are some exceptions. Sometimes we can overpay our credit card.

Debits are able to be increased or decreased. When you spend money by using the credit card, your credit card account will be in Credit(From) side. When you pay your monthly payment, it will be in Debit(To) side.

Income accounts do not have a balance.They have only statements. It is useful to see $600 what you received for your freelance works in February 2018 but seeing my total income is not because it depends on when you started use Librant.

Incomes are resources. They always give and never receive. Though there are some exceptions. For example: When you give some money back to your company because they overpaid your salary by mistake.

Because: Incomes are always are in Credit(From) side

Expense accounts do not have a balance.They have only statements. It is useful to see I spent $200 on bills in March 2018 but seeing my total bill expences is not because it depends on when I started to use Librant.

Expense accounts are targets. They always receive and never give. Of course there are some exceptions. For example: When you give a product back to the store and get your money back, expence account can be in From.

Because: Expenses are always are in Debit(To) side

Transfer account is being used to assign opening balance and to adjust in time.

Example 1: You created a new wallet. You really have $25 in the wallet. Now, you need to assign this balance to the account. Please see the transaction below.

Example 2: You realized that one of your wallets has $11 difference from real life and you don't know how it happened. Maybe you lost it. In this case, you can use transfer account again to fix the balance.

Transfer account is not able to have sub-accounts. It is one single account.

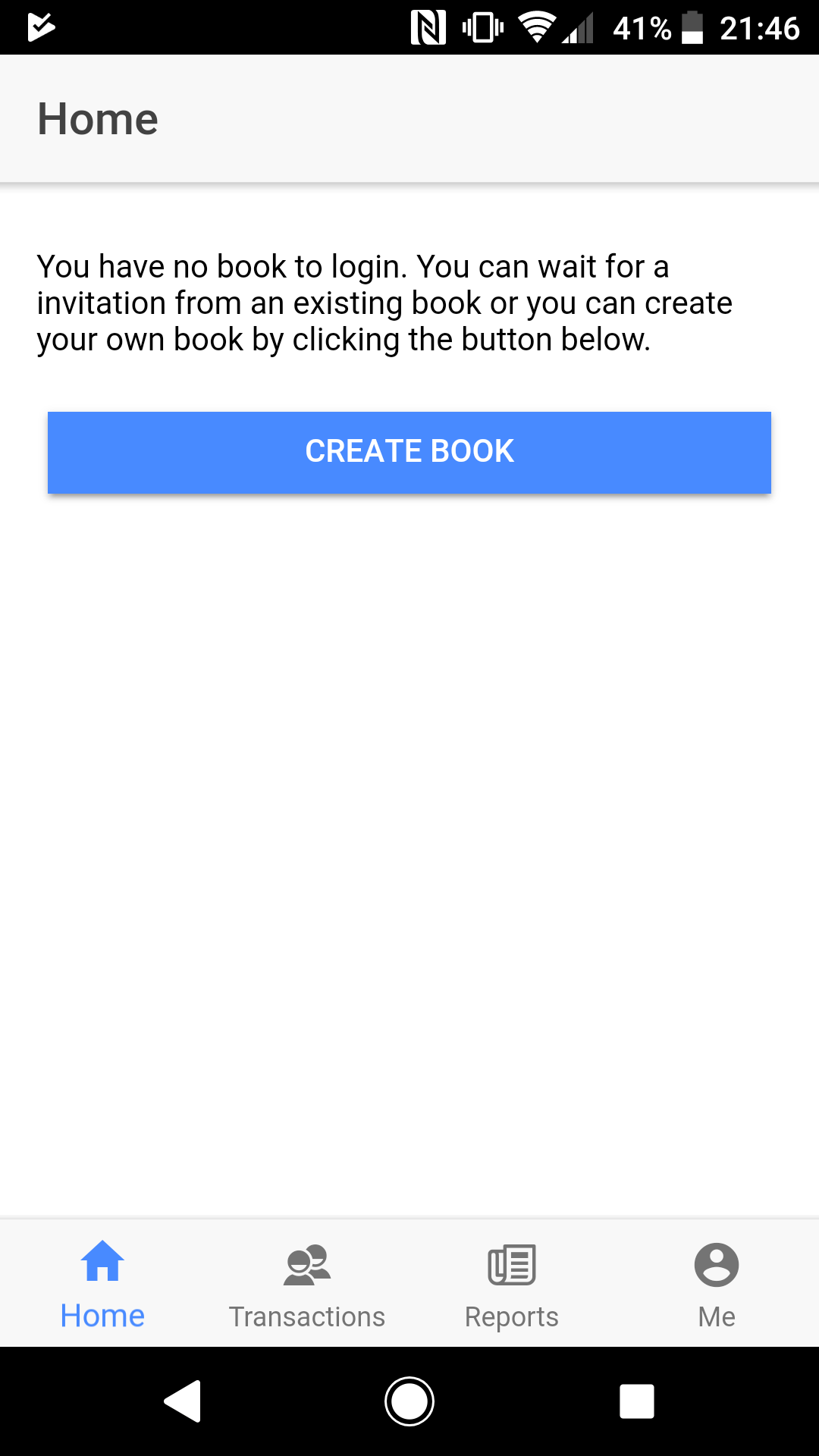

When you first login, Librant will ask if you want to create a new book or to wait for an invitation for another book. In this chapter we will only tell you about creating a new book and using it.

Please select Create a Book option in the page below.

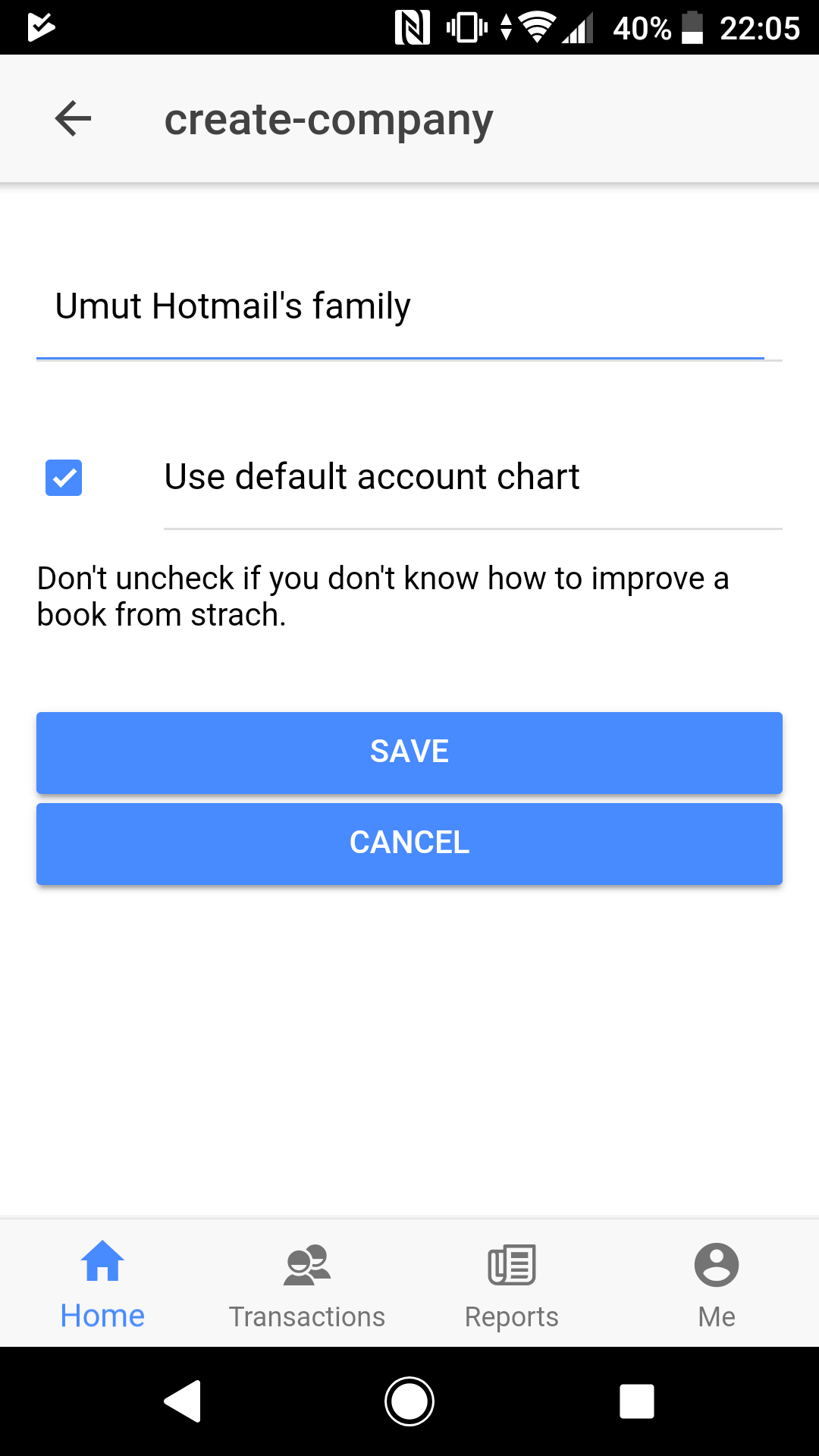

Now, give your book a name. It is usual to use your family name. For Maxwell Broneu, it is Broneu Family. But of course you can use a different name such as My treasure. It is possible to change this name anytime.

Librant will also ask about your account chart. You can use Librant's default account chart or you can crate from scratch if you prefer. For inexperienced users we suggest Librant's default account chart. This can be adjusted to suit your needs.

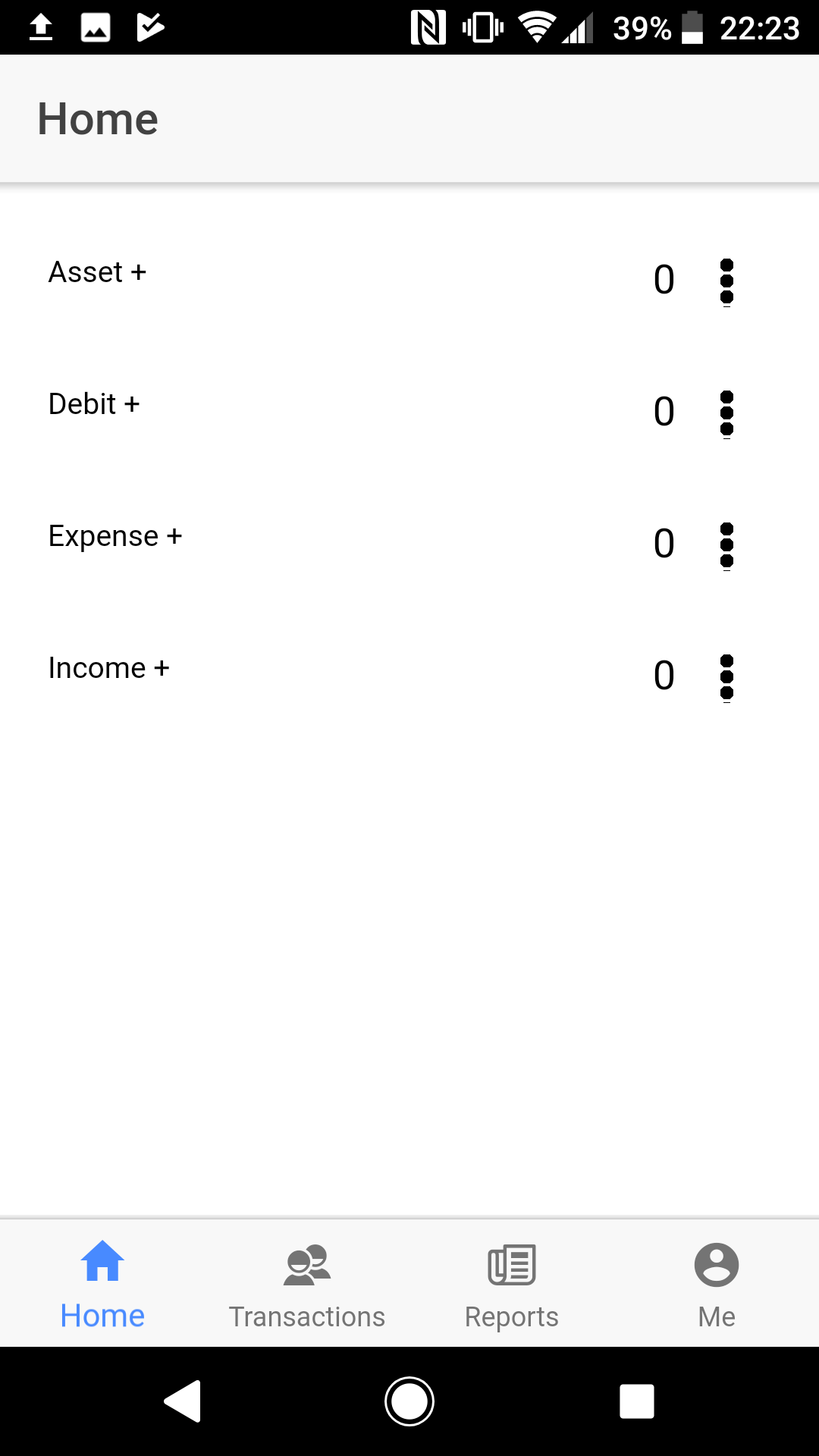

You have an account chart now. Let's start to use Librant step by step.

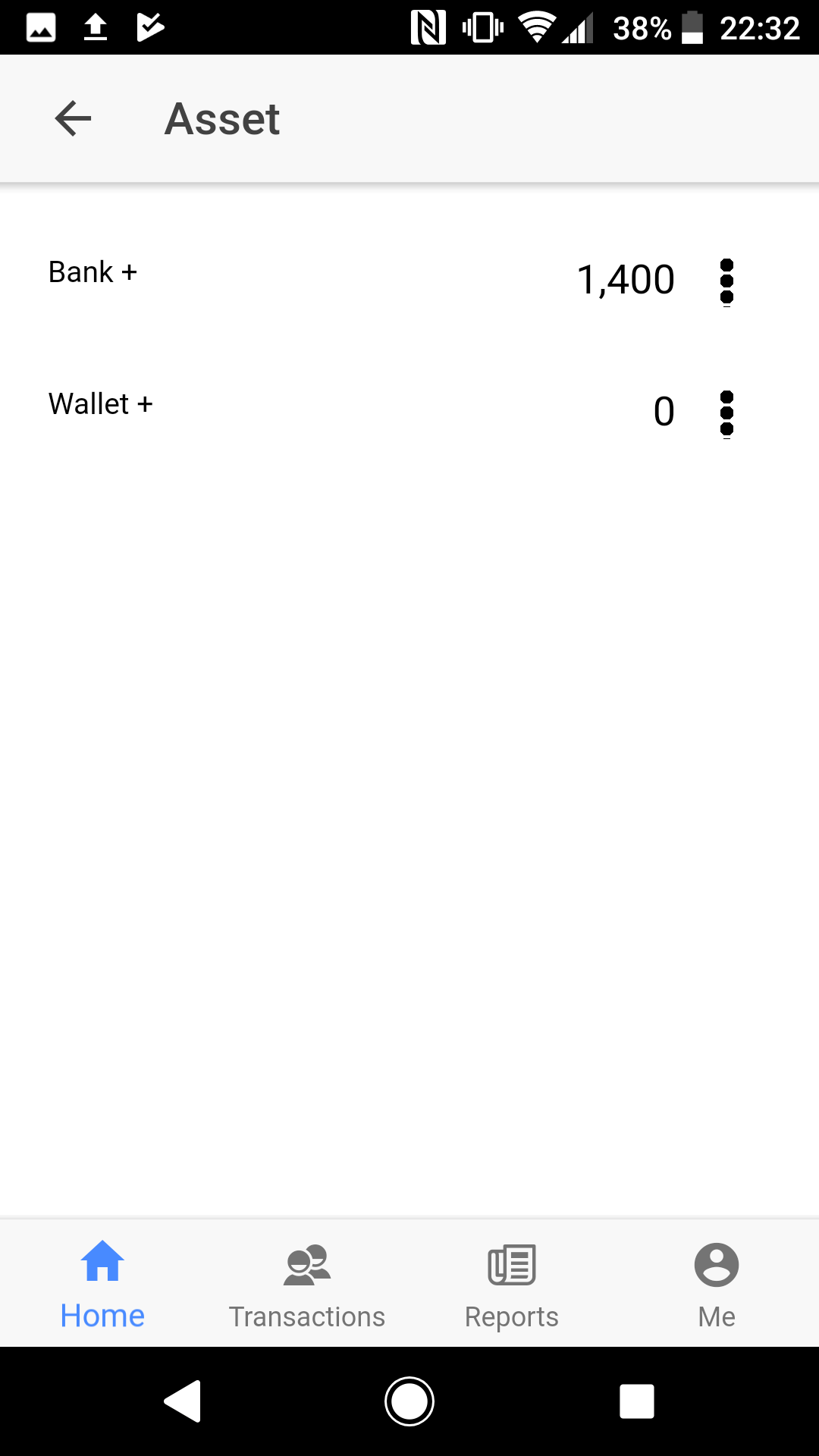

These are your 4 fixed accounts/categories. The plus symbol just after the account name indicates the account has sub-accounts.

Click Asset.

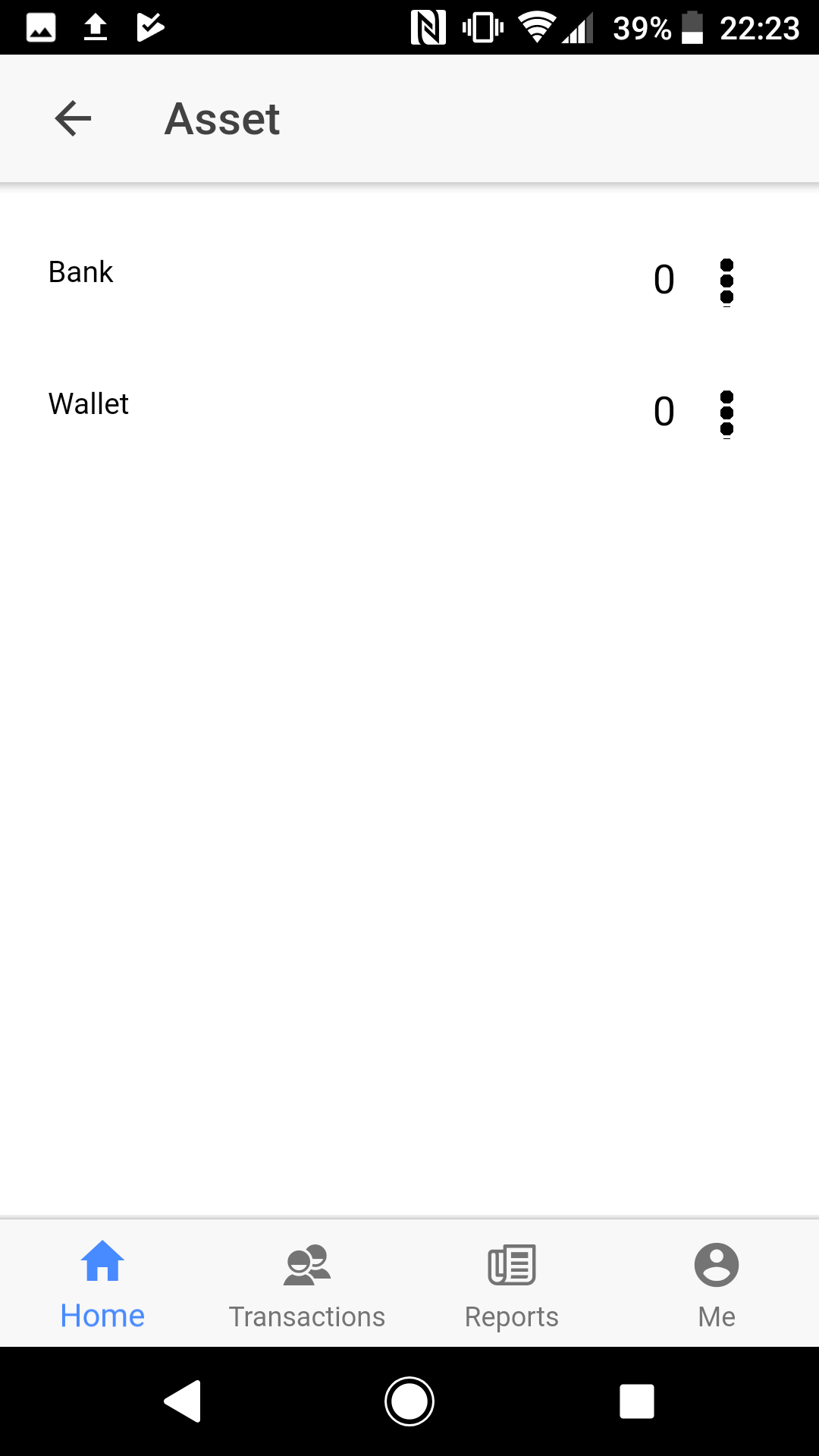

You are now seeing sub-accounts of Asset. These are Librant's default accounts. You don't have to use them and you can delete some of them later if not required. We will continue this "how to" lesson by using them.

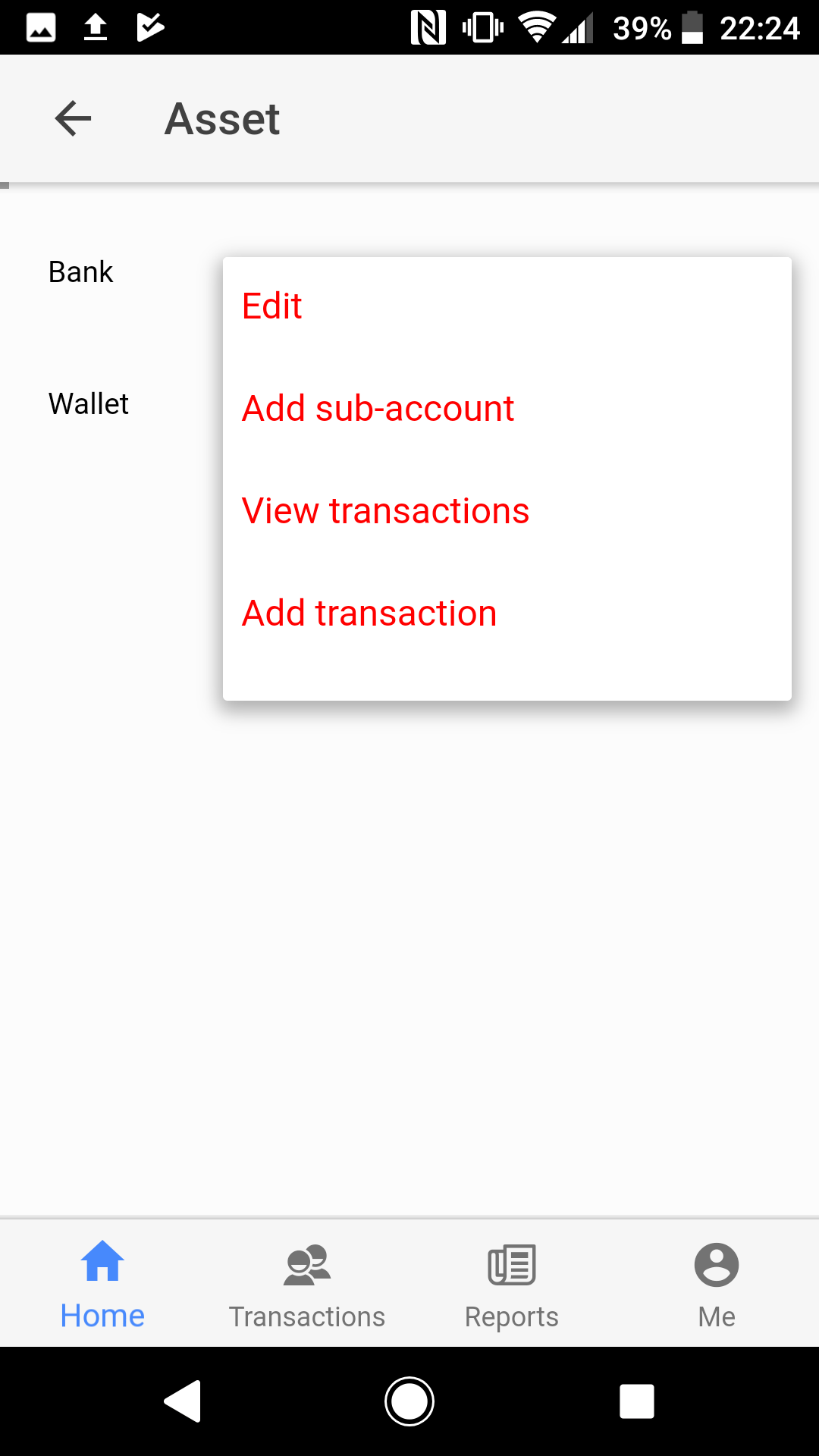

You and your partner have a number of bank accounts. Let's define them. Click the menu symbol to right of Bank row and then click Add sub-account.

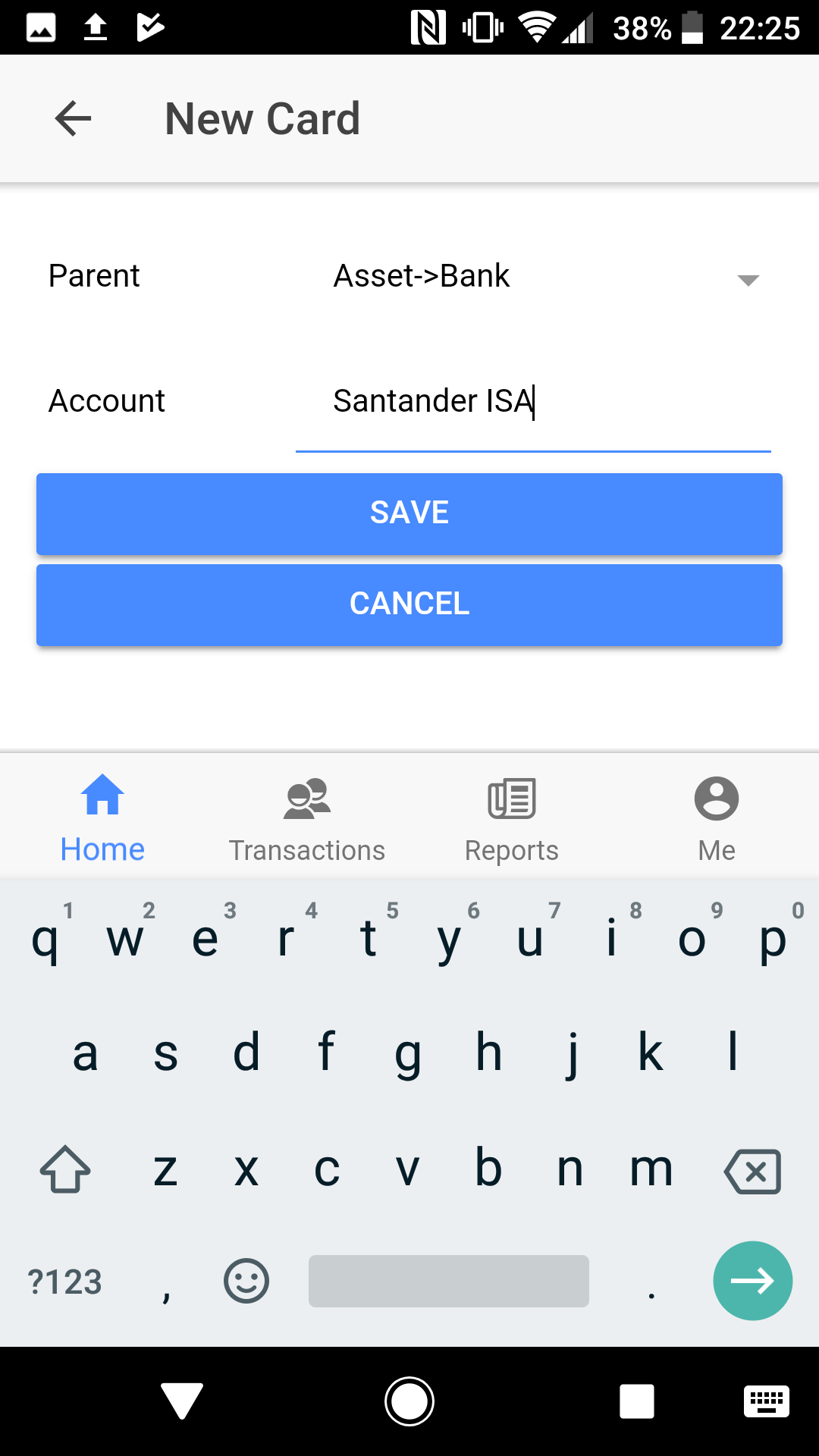

To add a new account under Asset->Bank type Santander ISA (or anything else) and click Save.

This automatically returns you to the previous page. Your new account has now been added.

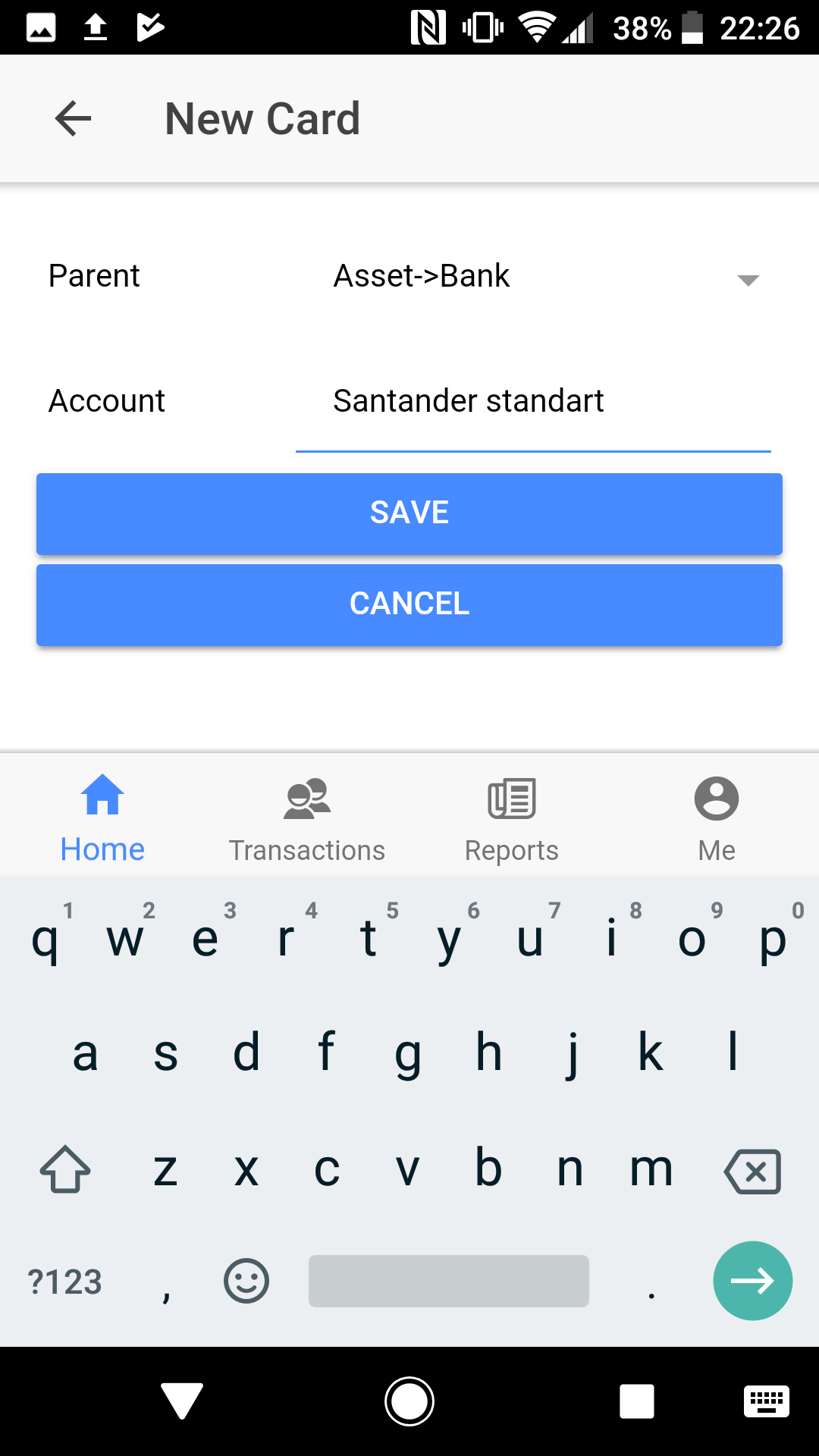

Let's define a new bank account. Again click the menu symbol to right of the Bank row and then click Add sub-account. Type Santander standard and click Save.

This automatically returns you to the previous page. Your new account has now been added.

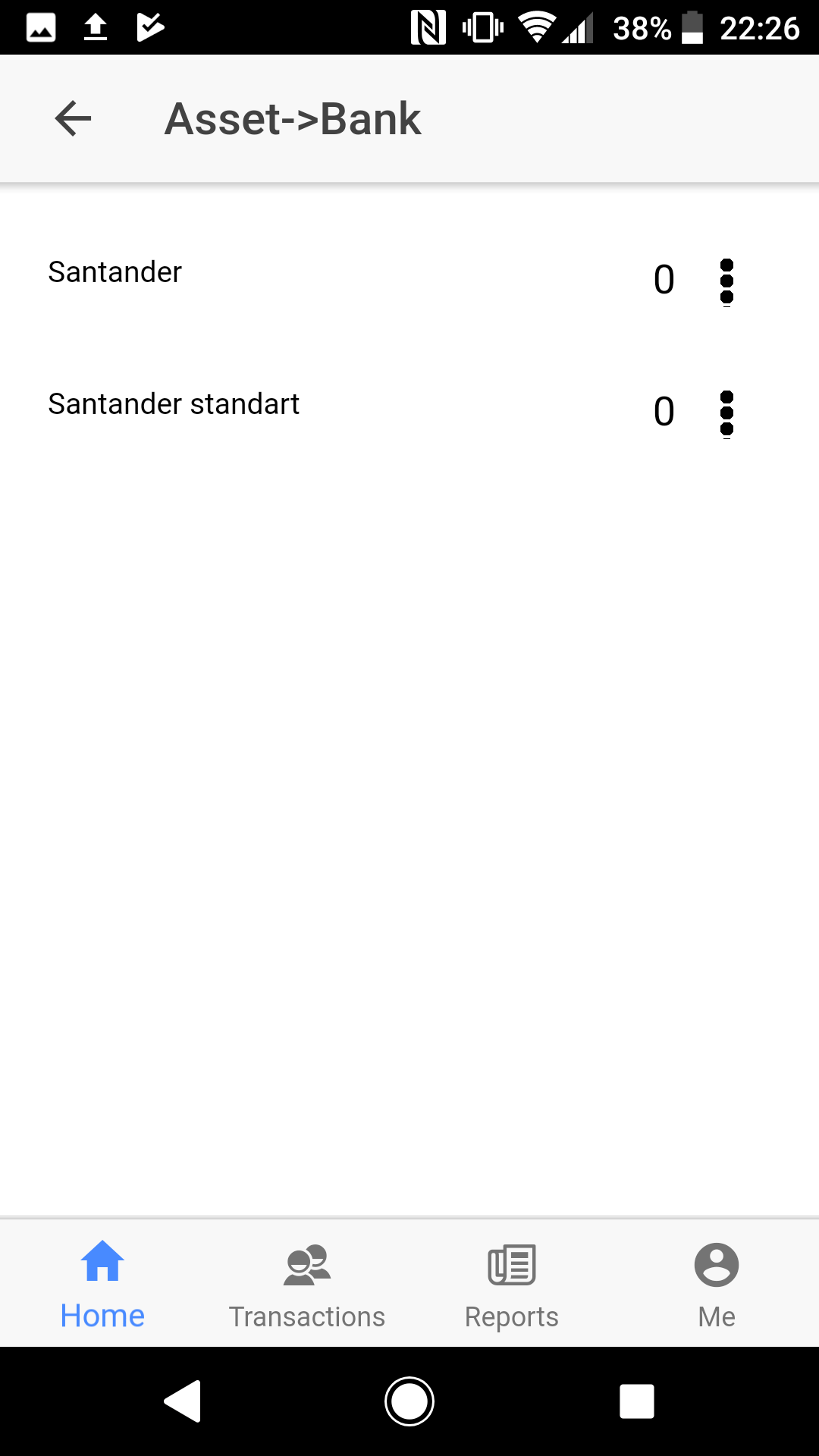

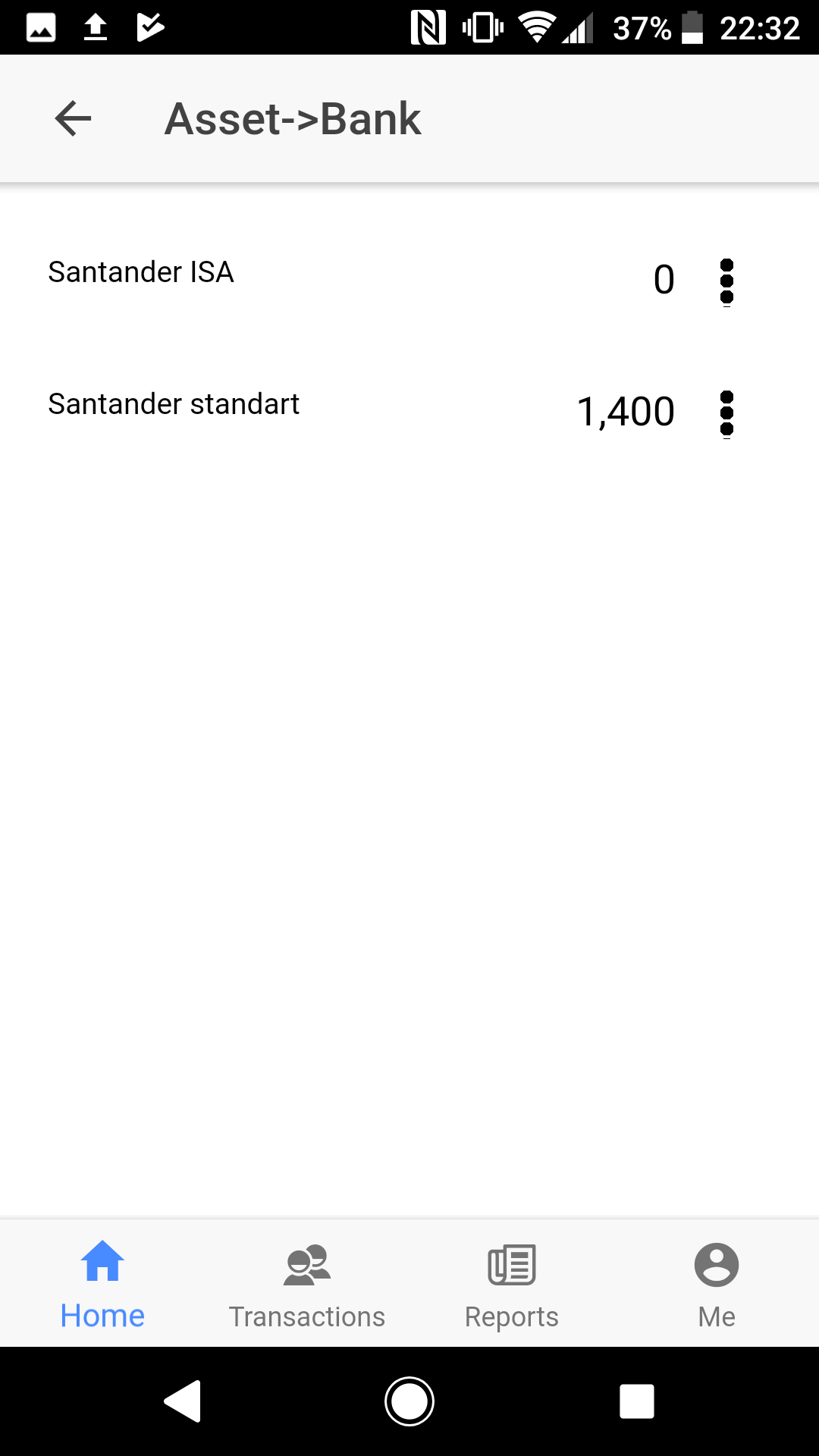

Let's look at the bank accounts. The Bank row now has a plus symbol. Indicates that it has sub-accounts. Click Bank.

You can now view sub-accounts of Asset->Bank. Now, let's create a wallet by using similar process.

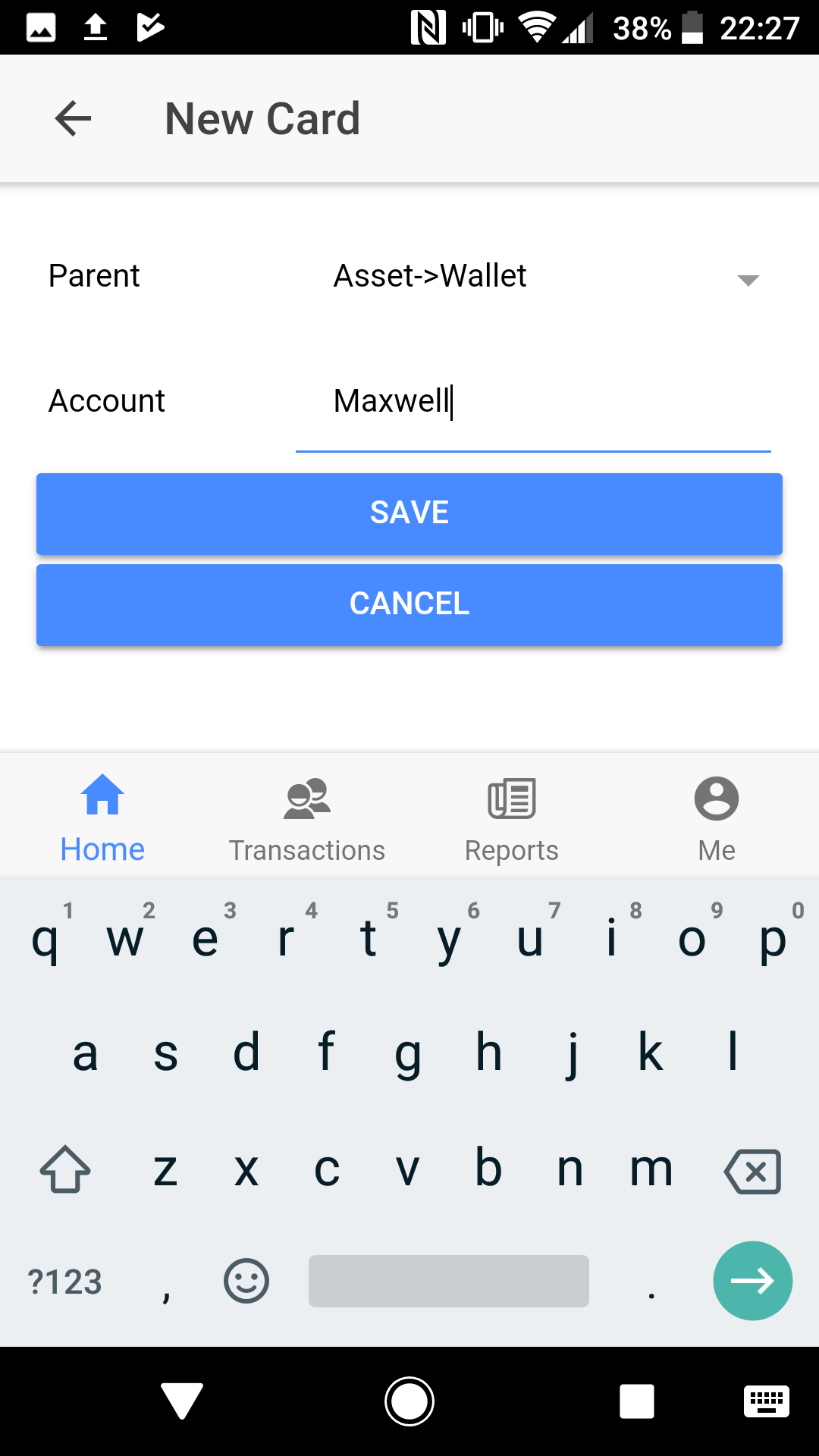

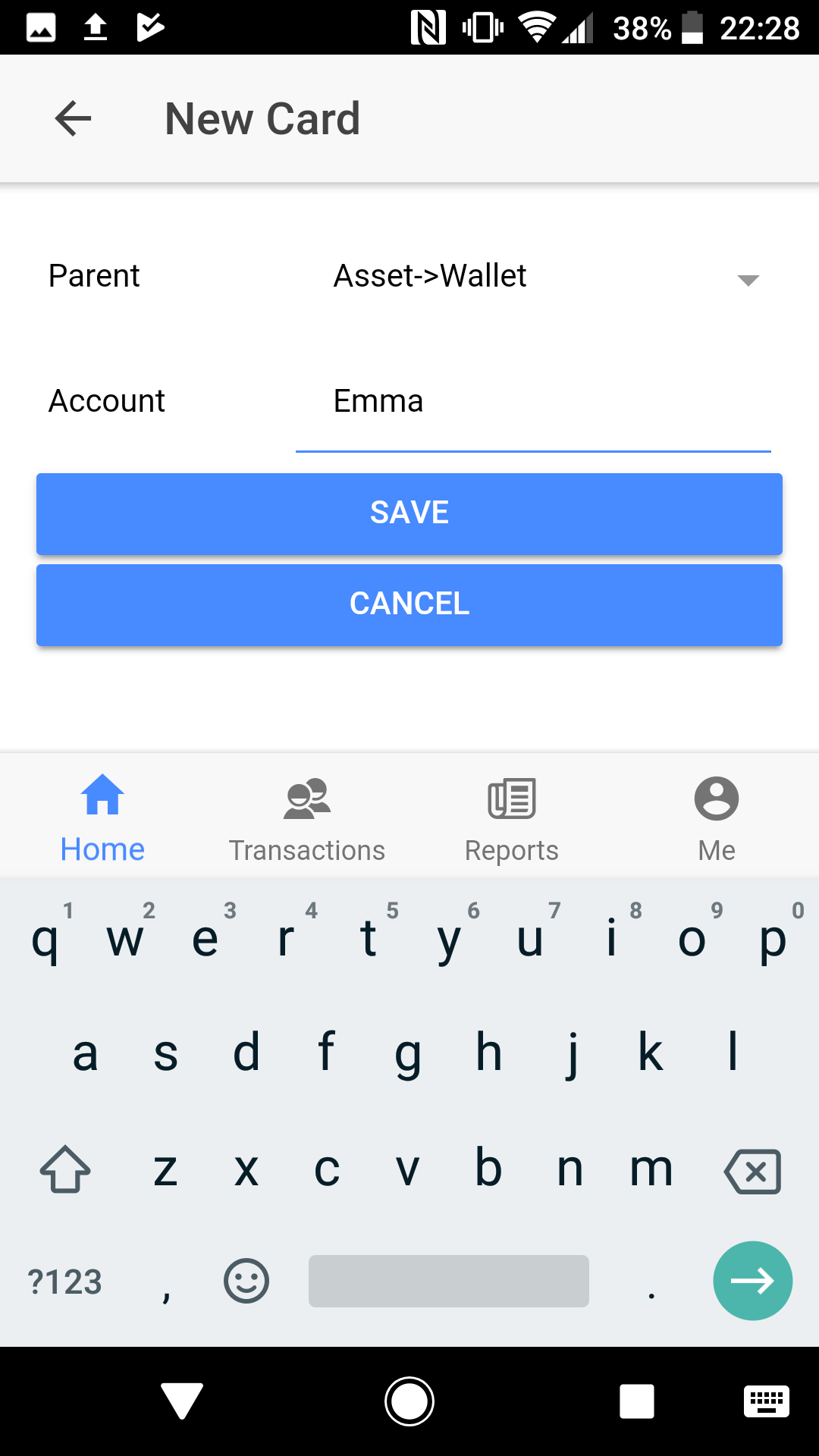

Click back arrow symbol in top bar. Click the menu symbol to the right of Wallet row. Then click Add sub-account. And then type Maxwell.

Repeat step 6. This time we are creating a wallet for Maxwell's wife. Type Emma

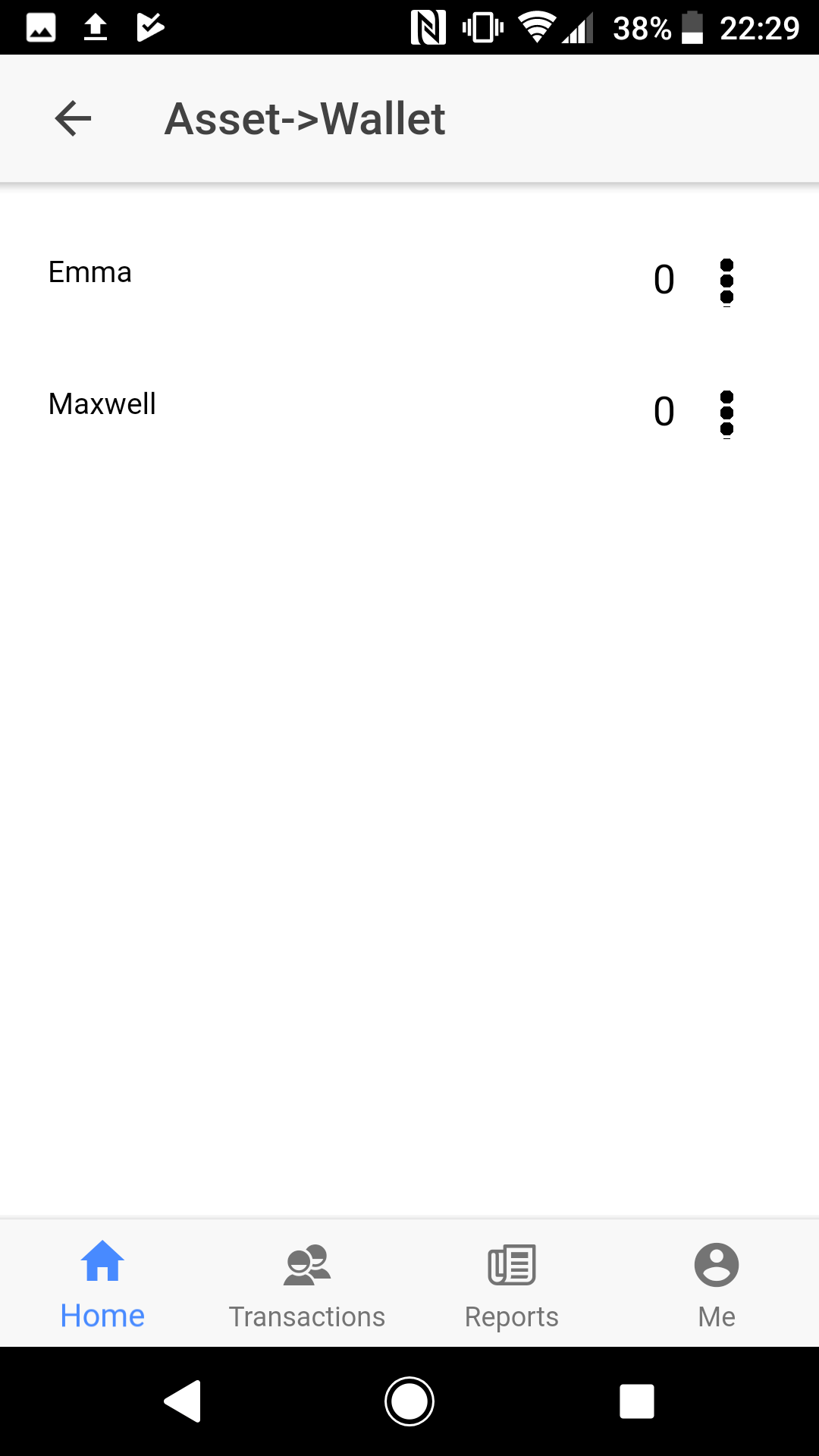

Go into Asset->Wallet and view your wallets.

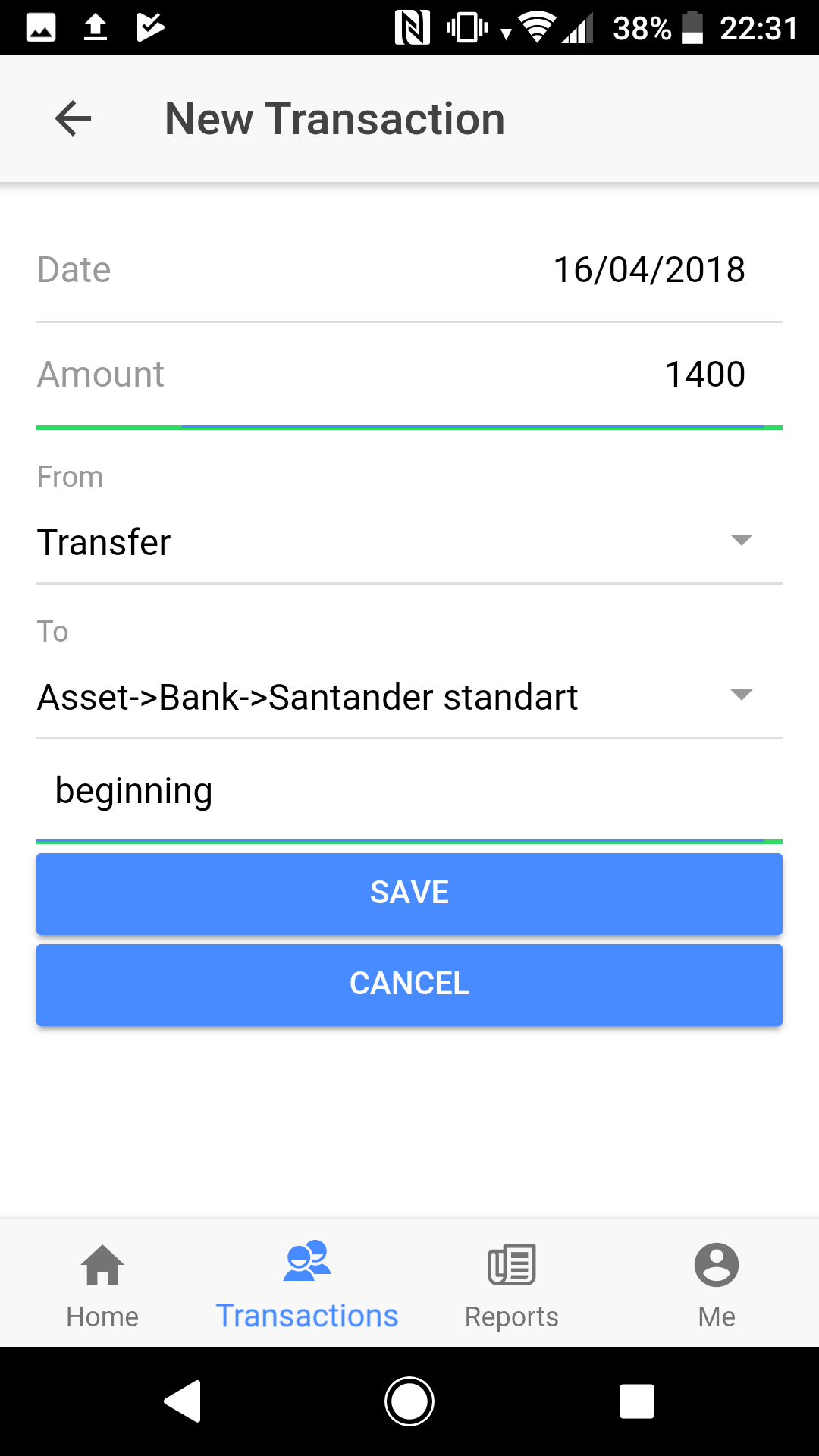

Now we have created some accounts. Let's put some money into one of them as an initial balance. Click Transaction tab in bottom tab bar.

Creating initial balance is only a transaction. Click plus symbol at top right corner.

In Amount box enter 1400.

In From box select Transfer.

In To box select Asset->Bank->Santander standard.

Description is not mandatory but this time type beginning.

Click Save button.

You can now view your transaction in the transaction list. Let's see the difference this has made to your accounts.

Click Home tab in bottom tab bar. You can now see 1400 in Asset row. Click Asset row.

You can now view your assets.

Click Bank row.

You can now view your bank accounts. There are no plus symbols in rows which means there are no sub-accounts on these accounts.

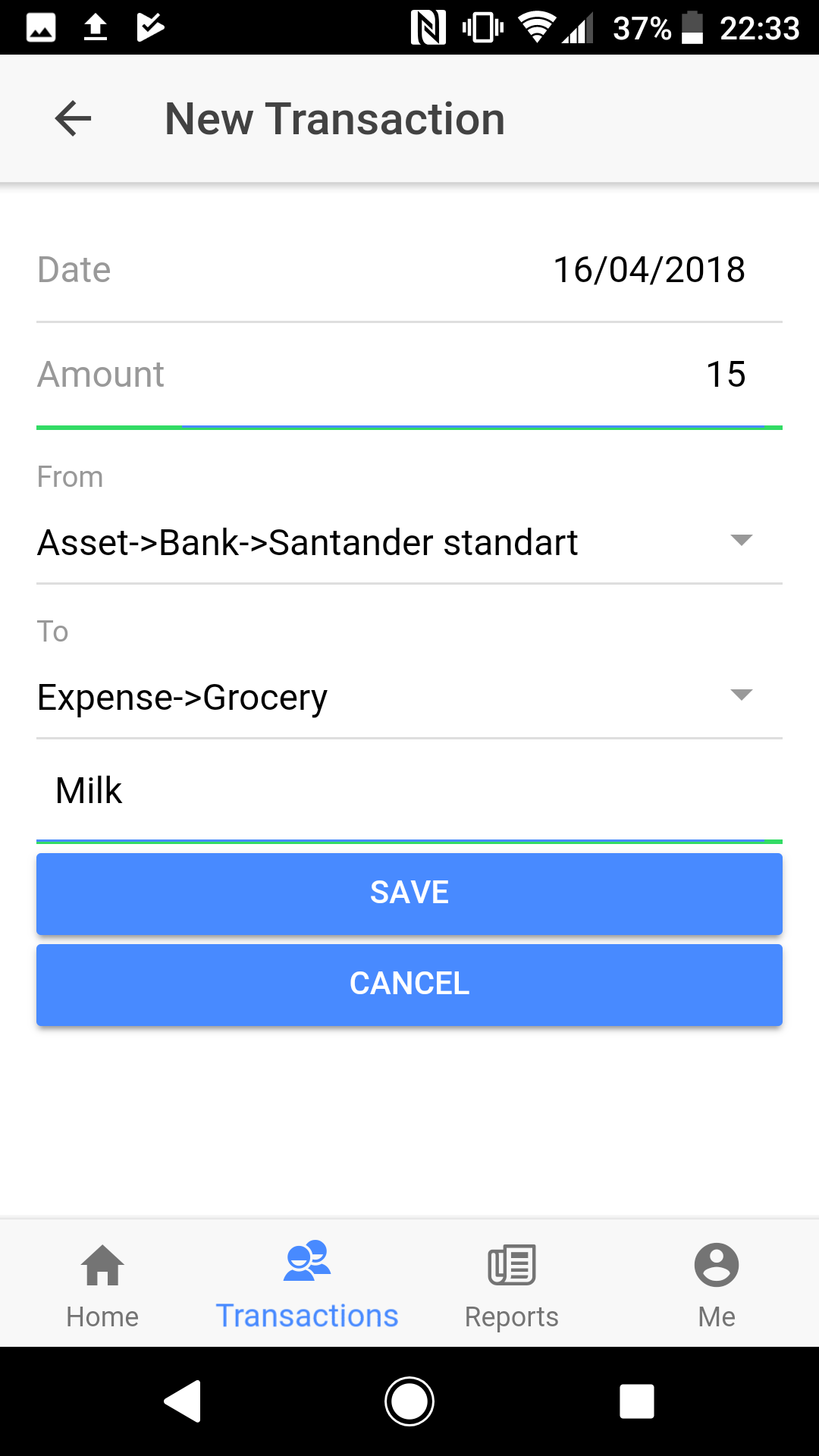

Now let's spend some money by entering a new transaction to Expense.

Go to transaction page and click plus symbol in top right corner.

In Amount box enter 15.

In From box select Asset->Bank->Santander standard.

In To box select Transfer

Description is not mandatory. Enter Milk.

Click Save button.

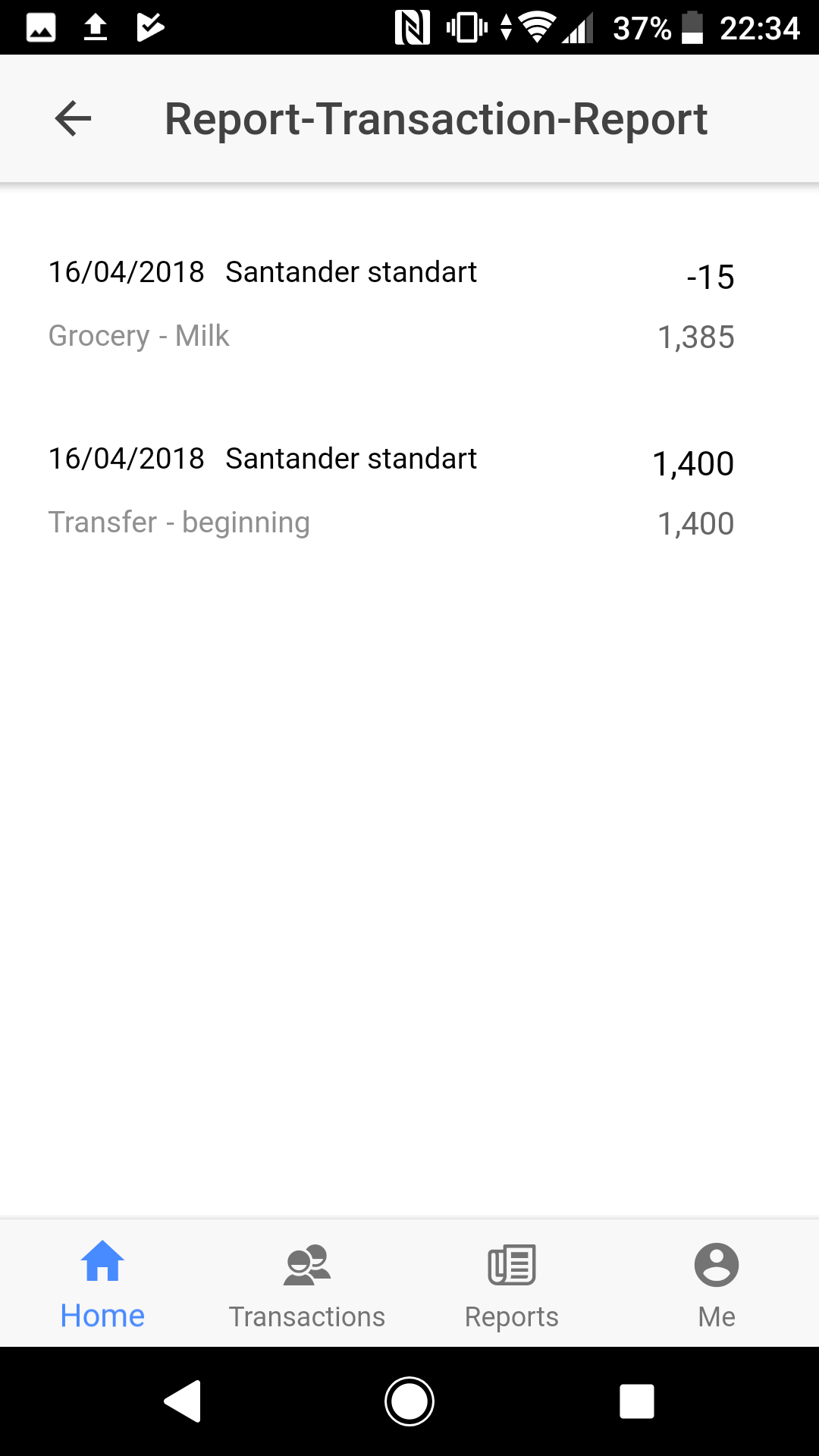

Let's see a report.

Click Home tab in bottom tab bar. Click Asset row. Click Bank row.

Click the menu symbol just right of Santander standard row and then click View transactions.

As you can see, 1400 was debited to the account and then 15 was credited to Expense.